nikon收購

Lytro CEO admits competing with Canon,

nikon收購nikon, and smartphones was a losing game

Lytro CEO admits competing with Canon,

nikon收購nikon, and smartphones was a losing game

/

The goal now is to reshape VR, not consumer cameras

Share this story

Building the “cameras of the future” doesn’t necessarily mean that those cameras will actually have a future. In a very frank and straightforward assessment of Lytro’s business posted on Backchannel, CEO Jason Rosenthal has tried to explain why his company chose to walk away from the consumer camera market. “The cold hard fact was that we were competing in an established industry where the product requirements had been firmly cemented in the minds of consumers by much larger more established companies,” Rosenthal wrote.

Despite the fact that Lytro cameras possessed a stunning trick (the ability to refocus images after the fact), other obstacles like large file sizes, lower resolution, and their expensive cost made keeping up with those “established” companies impossible. And then, these days a lot of people are just fine using a smartphone as their primary camera. “Consumer camera market was declining by almost 35 percent per year driven by the surge in smartphone photography and changing consumer tastes,” said Rosenthal.

The ability to refocus photos wasn’t enough to make Lytro cameras successful

He notes that continuing work on third- and even fourth-generation products would’ve quickly eaten up half of the $50 million that Lytro recently raised. “A financial bet of this size was almost guaranteed to end the company if we got it wrong,” he said. So instead, Rosenthal determined the right decision for Lytro was to take its advancements in light field photography in a different direction: virtual reality. “The more I looked at the needs of this market, the more convinced I became that we had something unique to offer.”

Last November, the company unveiled a VR camera rig it calls the Lytro Immerge. “This change in strategy also led Lytro to “dramatically” cut its staff. After all that, Rosenthal seems certain that the new Lytro is a better Lytro. “My middle of the night panic attacks are gone. I wake with a burning desire to go to work because I am so excited by what we are building and its potential to help shape VR.” The dream of reshaping consumer cameras, however, has been abandoned.

Canon EOS M 系列也在近期宣布終結。(圖片來源/Canon 提供)

Canon EOS M 系列也在近期宣布終結。(圖片來源/Canon 提供)

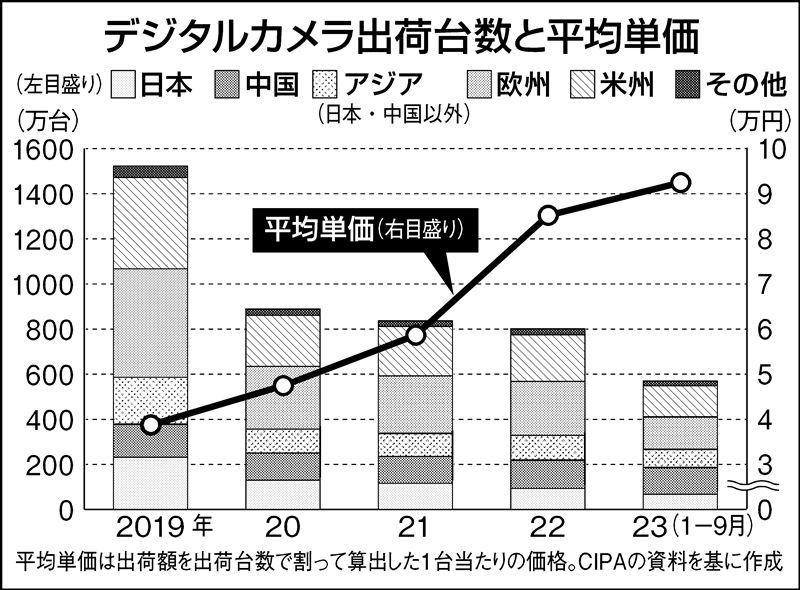

相機未來只有中高階款可以買?根據《Newswitch》釋出最新圖表顯示,從 2019 以來,數位相機出貨量大砍三分之二,平均售價卻是狂飆 2 倍,各大品牌正在全力專攻高階用戶。

從《Newswitch》發布的圖表可以看到,2019 年全球數位相機出貨量仍有約 1500 萬台,到了今年一至九月卻僅剩不到 500 萬台,數量只剩下三分之一。產品的平均價格也從約 4 萬日圓(約 8,479 元),翻倍漲至 9 萬日圓(約19,081 元)。

長條圖為銷售數量,折線為平均價格(圖/翻攝Newswitch)

長條圖為銷售數量,折線為平均價格(圖/翻攝Newswitch)

《Newswitch》表示,為了強化中國市場並且在歐美、日本等地獲得復甦,各大品牌主打各種高單價的機型,像是

nikon收購nikon Z8 被點名有相當高的詢問度,單機身在台灣售價高達 122,500 元。各品牌也正在瞄準疫情後的旅遊復甦潮,積極地推廣產品。此外,為了迎接 2024 年的巴黎奧運,Sony 也在近期發表主打高速連拍的 α9 III,預計 Canon、

nikon收購nikon 也將推出對應運動攝影的機款,屆時又會是一場高階相機之間的比拚。

事實上,各大相機品牌已逐漸靠攏專業用戶,主打隨拍的類單眼面臨智慧手機的挑戰,Canon、Sony、

nikon收購nikon、Panasonic 均在 2019 年後,就已經不再有相關產品發表,轉戰可替換鏡頭的無反單眼相機,或是專門用於錄影的 Vlog 設備。

目前以類單眼的隨拍相機來說,仍是以富士的 X100 系列以及 RICOH 的 GR 最為著名,然而要價都是三、四萬元以上,面向的消費者已經與以往大不相同。

nikon收購

nikon收購

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/15759122/lytro.0.1459800232.jpg)